In the past few years, luxury conglomerates like LVMH and L'Oréal have been steadily raising prices, especially in their fragrance and high-end beauty lines. Prestige fragrances have seen some of the steepest hikes, with prices now about 30% higher than before the pandemic.

The main reason is that these products carry extremely high profit margins for luxury companies. The cost of raw materials in a bottle of high-end hand soap, lotion, or perfume is typically a fraction of the retail price. Instead, you're paying for branding, marketing, and mystique, and as a result, you're paying much more than the fair value of the product.

In this post, we'll dive into how four conglomerates - L'Oréal, Puig, LVMH, and Estée Lauder - are using strategic price hikes and fragrance divisions to boost their financial results. We'll also look at how consumers are responding, and how at Element Brooklyn we're taking a very different approach focused on affordability and sustainability.

L'Oréal & Aesop: Premium Pricing as a Strategy

L'Oréal, the world's largest beauty company, has a vast portfolio ranging from drugstore shampoo to luxury fragrances. On recent earnings calls, L'Oréal's leadership has been candid that raising prices is part of their playbook, especially in the higher-end segments.

An Aesop store on Regent Street, London. Credit: Adobe Stock.

An Aesop store on Regent Street, London. Credit: Adobe Stock.A prime example is Aesop, which L'Oréal acquired in 2023. Aesop's products have never been cheap: a 500 ml (16.9 oz) bottle of Aesop hand wash sells for about $43. These are extremely profitable products; the company reports an overall 87% gross margin.

Fragrance and luxury beauty are L'Oréal's growth engines right now. In 2025, L'Oréal reported that globally, "fragrance and haircare remain our two best-performing categories" across all markets. L'Oréal views maintaining pricing power in fragrance as key to its strategy and the acquisition of Aesop only reinforces that focus on high-end, high-margin scent and personal care products.

Puig & Byredo: Niche Fragrances Drive Growth

Spanish conglomerate Puig, which owns brands like Paco Rabanne and Carolina Herrera as well as niche fragrance houses like Byredo and Penhaligon's, is another case where fragrance is king. Puig is privately held, but industry coverage shows an aggressive expansion in prestige perfumes and a willingness to raise prices to keep profits strong. In the first quarter of 2025, Puig's sales rose 7.5%, with the company highlighting that its largest segment - fragrance and fashion - is its top performer once again.

A Byredo store in Shanghai. Credit: Leo Li

A Byredo store in Shanghai. Credit: Leo LiIt's worth noting that Puig's niche fragrance brands carry luxury price tags that have climbed quickly in recent years. Byredo's signature perfumes, for example, now sell for around $320 for a 100 ml bottle, roughly $94 per ounce. (Just a few years ago, the same bottle might have been $250; fans have quietly weathered several price jumps.)

LVMH & Loewe: High-End Scents Amid a Luxury Slowdown

French luxury behemoth LVMH is best known for leather goods and fashion, but it also has a substantial Perfumes & Cosmetics division housing brands like Dior, Guerlain, Givenchy Beauty, and also fragrance lines for fashion houses like Loewe. LVMH has leveraged fragrance as a growth lever, especially as some big-ticket luxury purchases slowed in 2024. For the first nine months of 2024, LVMH reported a 5% revenue increase in its perfume and cosmetics segment - a "bright spot" amid an overall luxury cooldown.

Loewe, along with luxury fragrance, has been a "bright spot" in LVMH's recent results. Credit: Adobe Stock

Loewe, along with luxury fragrance, has been a "bright spot" in LVMH's recent results. Credit: Adobe Stock Notably, LVMH has been expanding fragrance offerings at its fashion maisons like Loewe. With fragrance, LVMH leans heavily on marketing, with celebrity ambassadors (like Rihanna for Dior's J'adore, or the continued buzz from Johnny Depp's association with Sauvage), and price-creep via deluxe versions (e.g. more concentrated parfums, collector bottles, etc.). This might make for pretty photos and social media content, but it doesn't make for more effective product and doesn't change the ultimate customer experience. A bottle of hand soap is a bottle of hand soap no matter who's endorsed it or how much has been spent on marketing it.

Estée Lauder & Le Labo: Betting on High-Margin Perfumes

Estée Lauder Companies, another beauty giant, has likewise turned to its fragrance portfolio to ride out recent challenges. ELC owns a mix of designer fragrance licenses and niche luxury brands - including Le Labo, Jo Malone London, Tom Ford Beauty, Kilian Paris, and others - in addition to its core skincare and makeup lines. The past year has been rough for Estée Lauder, with overall sales down 2%, but it reported that by category, fragrance continued to outperform makeup, haircare and skincare: fragrance sales were up 2% for the year, led by Le Labo and Jo Malone London. Le Labo's net sales grew by strong double digits in 2024.

A Le Labo store in a shopping mall in Kuala Lumpur. Credit: Adobe Stock

A Le Labo store in a shopping mall in Kuala Lumpur. Credit: Adobe StockThese brands carry steep prices and often implement yearly increases. For instance, Le Labo's Santal 33 currently costs about $335 for a 100 ml (3.4 oz) bottle, or roughly $98 per ounce - up from around $280 a few years back. (In fact, Le Labo's smallest bottle, a tiny 15 ml, is $107, underscoring the premium).

Consumer Response: Sticker Shock and Seeking Alternatives

While these price increases have bolstered corporate revenues, they haven't gone unnoticed by consumers. Shoppers are increasingly aware that luxury beauty products cost more now than even a year ago. In a Vogue Business consumer survey, 41% said luxury items "no longer offer good value to justify the price". As economic conditions tighten, more shoppers are looking for value for money, ethical practices, and quality rather than just a prestigious name. Gen Z, in particular, is still buying luxury, but they're savvy - many wait for discounts, use resale or grey markets, or seek out alternatives.

The Gen Z "no buy" movement is one example of a recent reaction to overconsumption.

The Gen Z "no buy" movement is one example of a recent reaction to overconsumption. There’s also a cultural shift where conspicuous consumption is being re-examined. Lavish prices in beauty are increasingly met with criticism about whether that money is paying for true quality or just branding.

Element Brooklyn's Approach

Amid this landscape of price hikes and luxury posturing, Element Brooklyn positions itself as built on affordability and sustainability rather than exclusivity. The idea is to save money and reduce waste simultaneously.

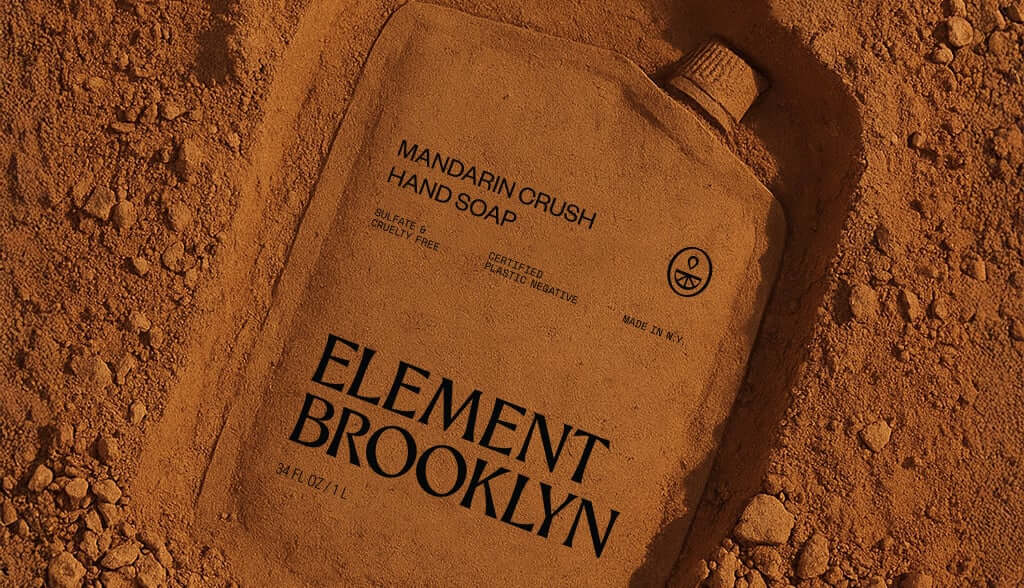

For example, our bestselling Mandarin Crush Hand Soap Refill costs far less than buying a new bottle of Aesop Resurrection Hand Wash, and has twice as much soap. (The same fragrance in a lotion format, the Mandarin Crush Hand & Body Cream, is even cheaper in relative terms: Aesop's bottle of cream costs $105.) And because they are refills, you're reusing bottles instead of tossing out packaging.

Mandarin Crush Hand Soap

$27.00

The orange, a timeless symbol of opulence and seduction, inspires our bestselling soap fragrance. Its fruitiness is underscored by woodsy and herbaceous notes of cedarwood and rosemary. A delectably sense-tingling hand washing moment. 🏆 HGTV Clean Home Awards 2025: Best… read more

Mandarin Crush Hand & Body Cream

$26.00

The perfect complement to our bestselling Mandarin Crush Hand Soap, this cream is rich yet easily absorbed and is suitable for both hands and body. The fruitiness of Mandarin and Valencia oranges is underscored by woodsy and herbaceous notes of cedarwood… read more

The current state of the beauty industry presents a sort of split reality. On one side, the giants of luxury beauty are doubling down on high prices and high margins, using fragrances as a profitable lifeline. They are banking on brand equity, emotive storytelling, and consumer tolerance for paying more in exchange for a taste of luxury. However, as they push prices too far, consumers will push back, either by cutting consumption or finding alternatives. We're already seeing this in the rise of "dupes" and the sentiment that "luxury isn't automatically worth it" anymore.

On the other side, brands like Element Brooklyn challenge the notion that high price equals high quality. Why can't we enjoy luxurious scents in our home without repeatedly paying luxury markups? The soap and lotion on your counter or the candle in your living room should spark delight – not buyer's remorse. Luxury is evolving, and it may smell just as sweet at a lower price.